What's Click Kabu 365?

Click Kabu 365?

Click Kabu 365 is the Japan's first exchange listed Equity Index Daily Futures contracts that TFX launched in November 2010. With its simple yet unique product structure, Click Kabu 365 soon caught the attention and interest of investors. One of the key characteristics of Click Kabu 365 is “Market-Making Method”, as Market Makers, will provide price and liquidity, and orders of the investors will be executed against the best available price quoted by those Market Makers.

Feature 1: Competitive Pricing Mechanism

TFX quotes the best prices of each contract (equity index) based on offer and bid prices offered by the Market Makers. The best price is compiled and updated automatically by selecting highest bid and lowest offer quotes submitted by the Market Makers.∗1 ∗2

∗1 Not all MarketMakers offer rates to all listed products.

∗2 It may become difficult or impossible for Market Maker to provide the offer and bid price in a stable and sustainable manner, depending on certain condition such as sharp fluctuations in the market etc., and as a result, the spread may become large and customer may not be able to trade at expected prices and suffer an unexpected loss therefrom.

Feature 2: Liquidity and Transparency

Click Kabu 365 is supported by the Market Markers and they provide efficient amount of the liquidity to the Click Kabu 365 market. In order to maintain its market transparency, TFX makes sure that the investors are able to visibly confirm, via their screen or TOP,the best prices of each contract and their tradable volumes in real-time∗

∗ The data are updated once a minute.

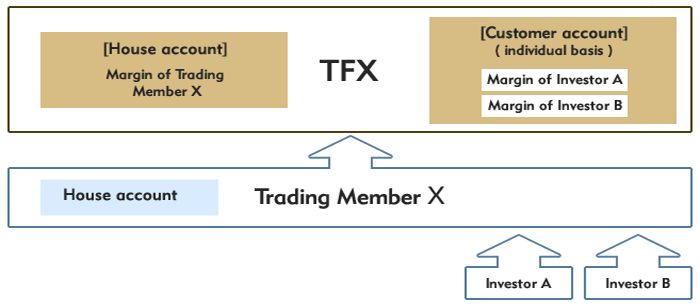

Feature 3: No Counterparty Risk

As a clearing house, TFX will be a counterparty of all transactions made by the investors. Also Trading Members of Click Kabu 365 need to deposit all margin collected from their clients to TFX in accordance with the Financial Instruments and Exchange Act, ensuring that funds of the investors will be separately kept and fully protected.

Feature 4: High Leverage

Leverage varies depending on the risk. Nomally 20~30 x.

Feature 5: Various Order Types

| Market Order | An order to buy/sell a contract at the best available price |

|---|---|

| Limit Order | An order to buy/sell a contract at a specified price or better |

| Market-if-touched (MIT) | An order that becomes a market order when a market price reaches a specified price. |

| One Cancels the Other (OCO) | An order consisting of two orders; when either is executed it cancels the other |

| If-Done | An order consisting of two orders: a first order will be executed as soon as market conditions met, and a second order will be activated only if the first order is executed. |