Reset

What does the "Reset" mean?

Reset means once-a-year settlement of outstanding position at Reset Price that is equivalent to the underlying asset's price.

Settlement is made at Reset Price (final settlement price for Click Kabu 365) for outstanding positions left unsettled until the Last Trading Day in December every year.

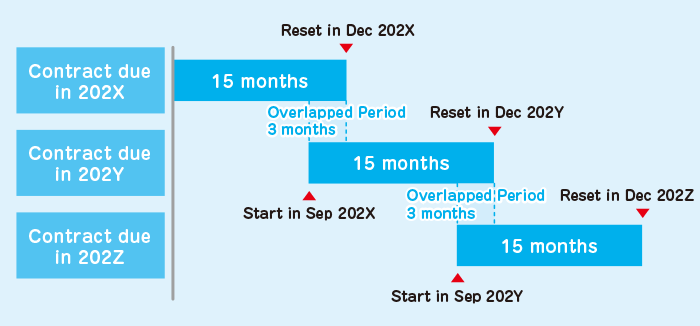

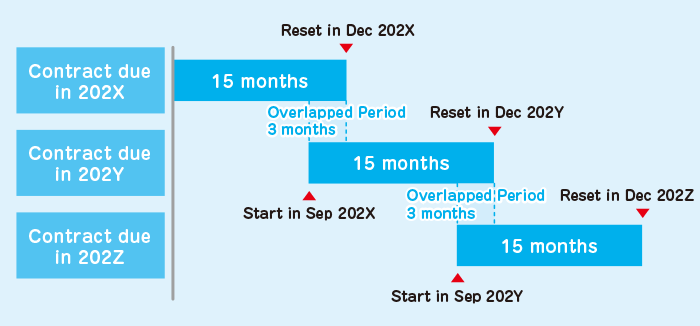

Schedule in summary: start and end (reset) of trading Click Kabu 365

Note: "First Trading Day" , "Last Trading Day" and "Reset Date"

For Click Kabu 365, the First Trading Day means a trading day on which trading of a contract with a new Reset Date is commenced. On Reset Date, positions unsettled or rolled-over until then are settled. The Last Trading Day is set on a trading day immediately preceding the Reset Date.

|

Nikkei 225 Daily Futures

Nikkei 225 Micro Daily Fuitures |

DJIA, NASDAQ-100, Russell2000, DAX®, FTSE100, Gold ETF, Silver ETF, Platinum ETF, WTI ETF Daily Futures |

| First Trading Day |

The trading day immediately following the Second Friday of September (Monday in principle) |

| Last Trading Day |

The trading day immediately preceding Reset Date |

The trading day immediately preceding the Third Friday of December of the following year of the contract commencement |

| Reset Date |

The second Friday of December of the following year of the contract commencement |

The trading day immediately following the Third Friday of December of the following year of the contract commencement |

What does "Reset Price" mean?

Reset Price is the final settlement price by which outstanding position held unsettled on the Reset Date is setlled

|

Reset Price |

| Equity Index |

The final settlement price of exchange-traded future of the equivalent undelying (December contract of the year Reset is made) rounded to the nearest whole number

※Nikkei 225 Micro and Russell2000 rounded to first decimal place

|

| ETF |

Net Asset Value (per Unit of the ETF of the equivalent underlying) of the third Friday of December

※Silver ETF rounded to first decimal place

|